The unprecedented importance of finance in our societies, as well as its central role in provoking economic crises, has generated an enormous interest in understanding the historical origins and evolution of modern financial systems. Today the U.S. economy is seen as an archetype of a capitalist system in which securities markets play a central role. Moreover, these markets have had a high profile in some of the most dramatic moments in U.S. history, often in the context of crises.

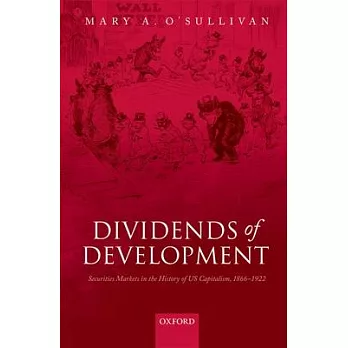

Dividends of Development: Securities Markets in the History of U.S. Capitalism, 1865-1922, explains how U.S. securities markets became central to the institutional fabric of U.S. capitalism. After the Civil War, these markets had a narrowly circumscribed relationship to the country’s real economy, being largely dominated by railroad securities. Moreover, their role in the U.S. financial system was of limited significance given the relatively modest resources that financial institutions committed to investment in, and lending on, corporate securities. That situation was to undergo fundamental change from the Civil War through the end of World War 1 but the development of U.S. securities markets did not occur as a result of a smooth, or even, linear process. Instead, the book shows that the transformation of U.S. securities markets occurred through a process that was volatile and time-consuming, unscripted by powerful actors, and driven, above all else, by the dramatic but unstable character of the nation’s economic development. These claims about the trajectory, the operation, and the underlying dynamics of the development of U.S. securities markets are brought together in a novel synthesis that portrays the historical evolution of securities markets in the United States as the "dividends" of the country’s distinctive trajectory of economic development.

天天爆殺

天天爆殺  今日66折

今日66折

博客來

博客來 博客來

博客來 博客來

博客來 博客來

博客來 博客來

博客來